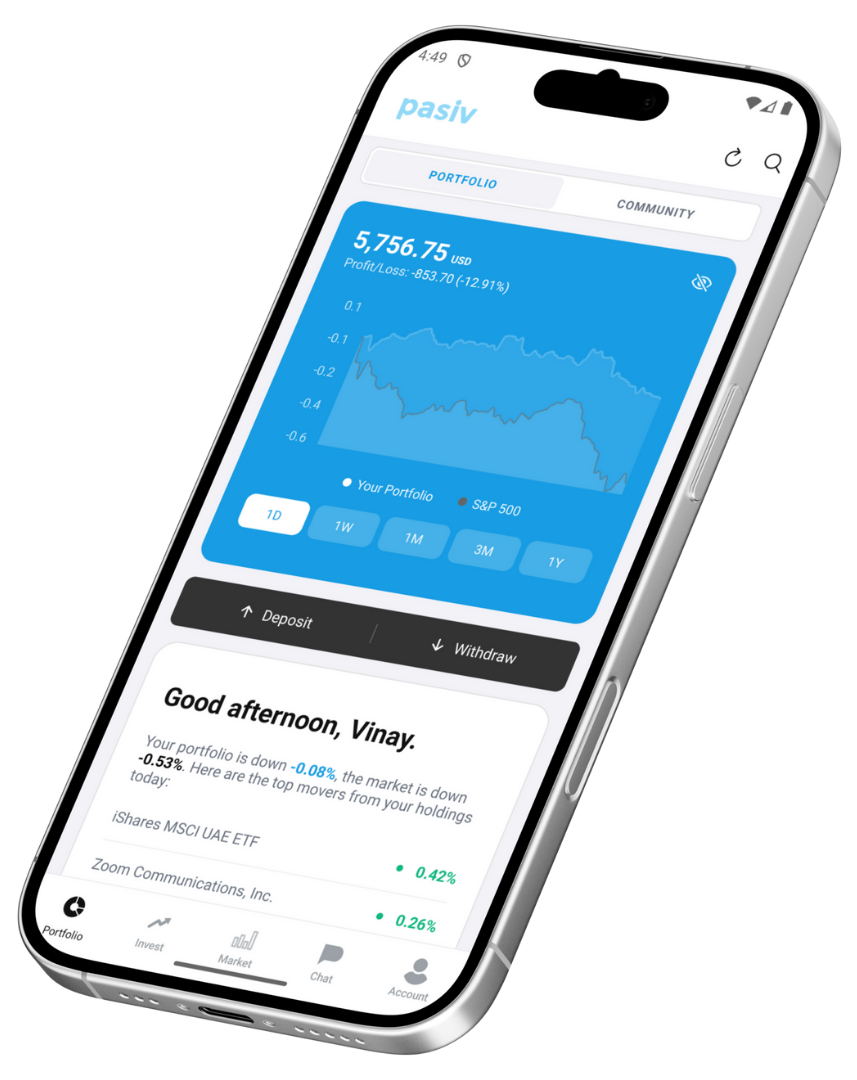

Build wealth on autopilot, with a fractional daily deposit

We turn small deposits into fractional stocks & ETFs. No effort required.

Watch your wealth grow while you focus on what matters most to you.

Zero Commission

Trade stocks & ETFs with no fees

Instant Deposits

Fund your account in seconds

Fractional Shares

Invest any amount you want

Human Support

Real people ready to help

Discover a world of diversified & thematic

funds issued by top tier investment houses globally

Access ETFs from 50+ world-leading asset managers

Simple, Smart Investing

Four steps to building wealth on autopilot

Pick your portfolio

AI helps you select diversified ETFs matched to your goals and risk tolerance

Link your card

Add a debit card as your funding source for seamless daily deposits

Set the amount

Choose a daily contribution or roundup your spare change - build a plan starting at $1 per day

Watch it grow

Your contribution buys fractional shares of your ETFs automatically, every day

No minimum balance • Cancel anytime

Manage your portfolio

through conversation.

Meet your AI wealth manager. Simply ask questions and have natural conversations to execute trades, research companies, monitor your watchlist, and track your wealth—gaining real insights and taking complete control of your financial future, all through chat.

Execute trades

Automated order execution at optimal prices

Smart alerts

Watchlist monitoring & market signals

Research assistant

Ask about any company, financials, or sector

MCP Server

Real-time progress toward your goals

A toolkit for the modern investor

Round up purchases and invest spare change, or setup a recurring daily deposit. AI agents manage your portfolio, track your progress, and guide your wealth journey—so you don't have to.

Spare Change Investing

Link your bank via OpenFinance UAE and set a roundup interval. We calculate daily roundups and invest based on your allocation preferences.

Automated Daily Deposit

Set a recurring daily amount from $1. Deposit as cash, invest fractionally across your portfolio, or choose basic index funds.

Financial AI Assistant

Execute trades, research companies, and monitor your watchlist through natural conversation. Get personalized insights instantly.

Community Insights

Share real-time alerts and portfolio performance with friends. Learn from top performers in your community.

Passive income that grows with you

If you're inclined towards regular income instead of growth, work with your AI assistant to build a portfolio that pays out. Start with one that can pay the Netflix subscription, and grow it into one that feeds your lifestyle.

Select income ETFs

Work with your AI assistant to select dividend-paying stocks and ETFs that match your income goals.

Receive Payouts

Get dividend payments deposited directly to your account on a monthly or quarterly schedule.

Re-Invest & Compound

Your automated daily deposits increase your holdings, generating more dividends over time.

Choose your path

Start free with curated funds, or unlock the full universe of investments

Starter Plan

Free forever

Round up purchases into 5 curated ETFs. Perfect for building the habit.

Includes a 1% deposit fee per auto-invest.

Full Access

For power users

Unlock 9,000+ stocks & ETFs. AI builds and rebalances your personalized portfolio.

Switch between plans anytime • No lock-in • Cancel anytime

Security at its best.

Pasiv Financial Ltd is regulated by the Dubai Financial Services Authority (DFSA) and comes with best-in-class security for your brokerage account, your funds and your data.

Encryption

Data on our platform is secured with 256-bit bank grade encryption to keep your information safe.

Safe Custody

Pasiv is affiliated with ChoiceTrade, an SEC regulated broker-dealer in the US & member of FINRA & SIPC.

Deposit Insurance

All ChoiceTrade accounts come with Securities Investor Protection Corporation (SIPC) up to $500,000.

Data Protection

Strict data privacy and security measures in line with the DIFC's Data Protection Law 2020.

Pasiv Updates

News from our community, market updates, and fintech thought pieces

Pasiv relocates to DIFC Innovation Hub

Exciting news as we move to the Dubai International Financial Centre Innovation Hub, joining the region's leading fintech ecosystem.

Pasiv Powers Ramadan Donations

Partnering with Founders Dubai Group to enable charitable giving during the holy month of Ramadan.

Turn Spare Change Into Wealth

See how our users invested +415% more in 2024. Every coffee you bought contributed to retirement.

Roundup Investing Launches

Hosted our second members meetup in Dubai, opening up early access to roundup investing.

Start investing today with Pasiv

Pasiv makes it easy to invest in diversified funds and build wealth passively. Download the app and start growing your portfolio today.

Join thousands of investors on Pasiv securing their retirement income.

Download app